Frequently Asked Questions (FAQ)

A unit trust is a collective investment scheme which pools together the money of multiple investors into a single fund. This collective pool of money is then invested in different forms of securities. Investors are allotted units for their portion of the investment in the fund, and unit holders share the resulting profits and losses in proportion with their investment.

Since the pooled resources are invested in many different securities, the risk gets diversified. Furthermore, investments are made by a team of professional fund managers who have the knowledge and experience with regards to financial markets.

All unit trust funds in Sri Lanka have to be licensed by the Securities and Exchange Commission of Sri Lanka (SEC). Moreover, the Asset Management Company that manages the unit trust funds are regulated by the SEC.

Unit holders receive a return on their investment in two ways:

- Appreciation of the unit price over time

- Dividend being distributed to unit holders

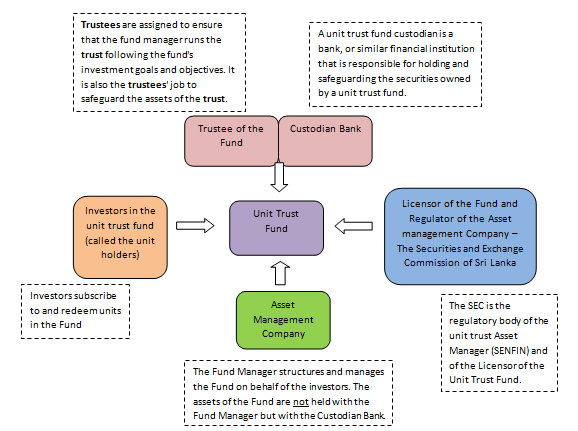

A unit trust has three main parties that are involved in its operations – An asset management company, a Trustee Bank, and a Custodian Bank (most times that Trustee Bank and Custodian Bank can be the same bank).

The trustee and custodian are independent from the Asset Management Company. They can be a bank and both functions can be undertaken by the same bank. The Trustee monitors the asset manager’s conformance with the trust deed and regulatory requirements.

The custodian is responsible for holding and safeguarding the securities owned by a unit trust fund. This is an added safety feature in the unit trust model.

In the case of our unit trust funds, the Trustee and Custodian of the funds are HNB Bank PLC.

- Diversification: You can hold a portfolio that contains several securities with a small investment. For example, with a investment of Rs. 1,000/-, you can be a unit holder of a portfolio that contains about 10-15 or more stocks, or in the case of a fixed income unit trust fund, such as a money market fund, you can hold fixed deposits in several banks and finance companies, investments in commercial paper issued by several companies etc.

- Affordability: Unit Trust investments are made affordable to retail investors so that even with a small amount such as Rs. 1,000, you can participate in a portfolio of shares, fixed income securities, government securities or a combination of any of these securities.

- Professional management: A fund manager is assigned to manage your unit trust fund, thereby eliminating the need for you to research stocks and check the best rates for fixed income securities such as FDs in the market. The research on macro economic conditions and performance of companies is undertaken by a team of professional analysts and fund managers.

- Ease of investment and convenience: Units can be bought and sold on any business day, so you can invest and withdraw your investment at any time.

- Transparency: a unit trust’s investment objectives and the instruments that the unit trust will invest in are clearly mentioned in the prospectus / explanatory memorandum of the fund. Therefore, a unit trust investor can choose if he or she wishes to invest in that particular fund. Furthermore, the performance of the fund is published on a monthly basis while the buying, selling prices of units and the net asset value per unit are published daily in the asset management company’s website. The unit trust company also has a legal obligation to publish an annual report as well as a half-yearly report on the performance of their unit trust funds.

- Regulation leading to your ease of mind: The asset management company that manages your unit trust fund is regulated by the SEC.

There are several ways in which you can classify a unit trust: according to their structure, according to the objective of the fund, according to the sector they invest in and even according to certain special requirements.

Structure Based

- Open Ended Schemes: Schemes without a fixed maturity period, that let you subscribe for or redeem units any time. They offer the benefit of liquidity.

- Close Ended Schemes: Schemes with a fixed maturity period, which are open for subscription for a specified duration during the launch of the fund. After the close of the initial subscription period, new investors as well as existing investors in the fund who want to increase or decrease their holding in the fund can buy or sell units of the scheme on stock exchanges where they are listed. As an exit route, closed ended unit trusts necessarily have to offer either a repurchase at market value, for a specific time frame or allow trading of units on stock exchanges.

Objective-based

- Growth Schemes: Schemes that invest in equities and are designed to offer maximum growth over medium and long term, ideal for investors who are in their prime earning years. These schemes are comparatively high risk and offer investors such options like capital appreciation and dividend option.

- Income Schemes: These schemes invest in fixed income securities, are less risky, and a good option for investors who want to generate steady income streams.

- Balanced Schemes: Investments are done in equity and debt securities to generate regular income and moderate growth. For example, these funds may invest 40% and 60% in equity and debt respectively, and their NAVs are likely to be less volatile than those of pure equity schemes.

- Liquidity/cash management Schemes: Safe, short term instrument investments to generate quick returns while still offering liquidity. Returns on these schemes fluctuate much less as compared to other funds and they are a good option for individual investors who want to park their surplus funds.

- Gilt Funds: For investors who are looking for extremely safe investments, these schemes invest only in government bonds and securities. While these schemes have no default risk, their NAVs still fluctuate as a result of change in interest rates and other economic factors.

- Index Funds: These funds invest exactly according to the portfolio and weightage of a specific stock exchange index. Their NAVs rise and fall according to the changes in the index, with a slight difference in percentage. These could also be Exchange traded Funds (ETFs), which get traded on stock exchanges.

Sector Based and Specialty Funds

- Sector Specific Funds: Invest in funds of companies based on certain sectors that are booming or are expected to do well considering the prevalent market situations. The returns of these funds depend on how the sector performs, and it is important to track sectors carefully, or seek help from an expert while investing in these funds. Though high on returns, these funds tend to be riskier as compared to diversified funds..

- Specialty Funds: These funds may focus on socially responsible investing, Shariah compliant investing etc. For example, a socially responsible fund may invest in companies that support environmental initialtives, human rights and diversity, whilst Shariah compliant funds will avoid companies involved in alcohol, tobacco, gambling, weapons and certain leisure etc.

Selling / Creation Price

Is the price you pay when you invest in a unit trust fund; also called creation price. It may or may not include a front end fee.

Buying / Redemption Price

Is the price at which open-ended schemes repurchase their units from you and close-ended schemes redeem their units on maturity.

To decide which scheme you should invest in, understand your investment goals and match them to the objectives, expected returns and previous performance track record of the unit trust scheme you are considering. Begin by answering these simple questions for yourself and then reaching out to a financial expert for guidance.

- What is your age?

- How much money can you invest?

- For how long can you invest the money?

- How often do you need the returns?

- How much risk can you handle?

- Will you need money in the recent future?

Read the offer document carefully, track the past performance of the scheme, compare it with others in its category and evaluate the quality of the securities that the scheme is planning to invest in.

Then talk to a fund manager or sales agent of the asset management company to understand which fund is best suited for you.

- Citizens of Sri Lanka and companies and institutions incorporated in Sri Lanka

- Foreign citizens; foreign citizens and companies can invest only via an Inward Investment Account (IIA). An IIA account enables foreign investors to convert and repatriate capital and profits back into your account. The IIA account is designed to avoid domestic exchange control restrictions of the Central Bank.

- Minors as the first holder when applied jointly with parent, legal guardian or curator

- Approved provident funds and pension schemes Registered in Sri Lanka

- Global, regional and country funds, also via an IIA.

- Application Form which includes questions pertaining to Know Your Customer (KYC) requirements

- Investment Form

- Proof of Identification, Address and Bank Account Number

- Cash deposit slip or Fund transfer slip in the form of an attachment if applying via email or online platforms; original if documents are being delivered

- A cheque or bank draft drawn in favour of Senfin Money Market Fund. Cheques or bank drafts should be crossed “Account Payee Only”. Cash cheques will not be accepted.

- Cash deposits, fund transfers and inward remittances could be affected to the Fund’s collection account at Hatton National Bank PLC.

- Cash will not be accepted by the Fund Manager.

Applications received after 3.00 p.m. will be carried forward to the next business day.

Application forms for purchase of units can be obtained from the registered office of the Fund Manager or distributors/agents appointed by the Fund Manager from time to time or can be downloaded from the Fund Manager’s website: http://www.senfinassetmanagement.com. Investors can also apply for units via the Web Portal or Mobile Application of the Management Company.

Minimum investment value in the fund will be LKR1,000/-. If the investment value is below LKR 1,000/-, the Fund Manager reserves the right to refuse the application for Units in the Fund. Units will be issued to a fraction of 1 dp and rounded down based on the unit price applied on the date of investment.

The latest available Selling Price and Buying Price of the Fund will be published in a leading daily Sri Lankan Newspaper and in the Fund Manager’s website.

- A Unit Holder of a Scheme shall be entitled to have his Units repurchased or redeemed in accordance with the terms of the trust deed of the Scheme at a price which is related to the NAV of the Units and determined in accordance with the terms published in the KIID.

- Units may be redeemed on any Business Day at the Fund Manager’s Buying Price calculated at the end of that Business Day, provided the Fund Manager receives before 3.00 p.m. the completed and valid redemption request by email, via the online or mobile platforms, via facsimile, or physical delivery. In the case of joint holders, both parties must sign the redemption request letter, facsimile or redemption request form, if the operating instruction on the application mention that both parties jointly would be giving instructions. Any request for redemption after 3.00 p.m. will be processed on the following Business Day. Redemption Request Forms can be obtained from the registered office of the Fund Manager or can be downloaded from the website of the Fund Manager, http://www.senfinassetmanagement.com/.

- Unit holders can redeem their Units on any dealing day in whole or in part provided the minimum holding is not less than 100 Units after such redemption is made. If the number of remaining Units is less than 100 Units, the Fund Manager’s reserve the right to redeem the remaining Units and pay the proceeds to the investor.

- Payment of redemption proceeds will be made in Sri Lankan Rupees to the first holder, by way of a direct transfer to the bank account indicated in the Initial Application Form or Redemption Request Form or by way of a crossed cheque marked “Account Payee Only” in the absence of a bank account, which will be dispatched by registered post.

- The maximum interval between the receipt of a valid request for redemption of units and the payment of the redemption money to the Unit Holder, shall not exceed ten (10) business days from the day on which the request was received. Where, for any exceptional reason, it is not feasible or desirable to make payment of the redemption money within ten (10) business days, the Commission shall be notified forthwith giving reasons as to why such payment should not be made within ten (10) business days..

- Where redemption requests on any Business Day exceed ten per centum (10%) of the total number of units in issue in the Fund, the redemption requests in excess of the ten per centum (10%) may be deferred to the next dealing day provided the SEC is notified in writing of such deferral.